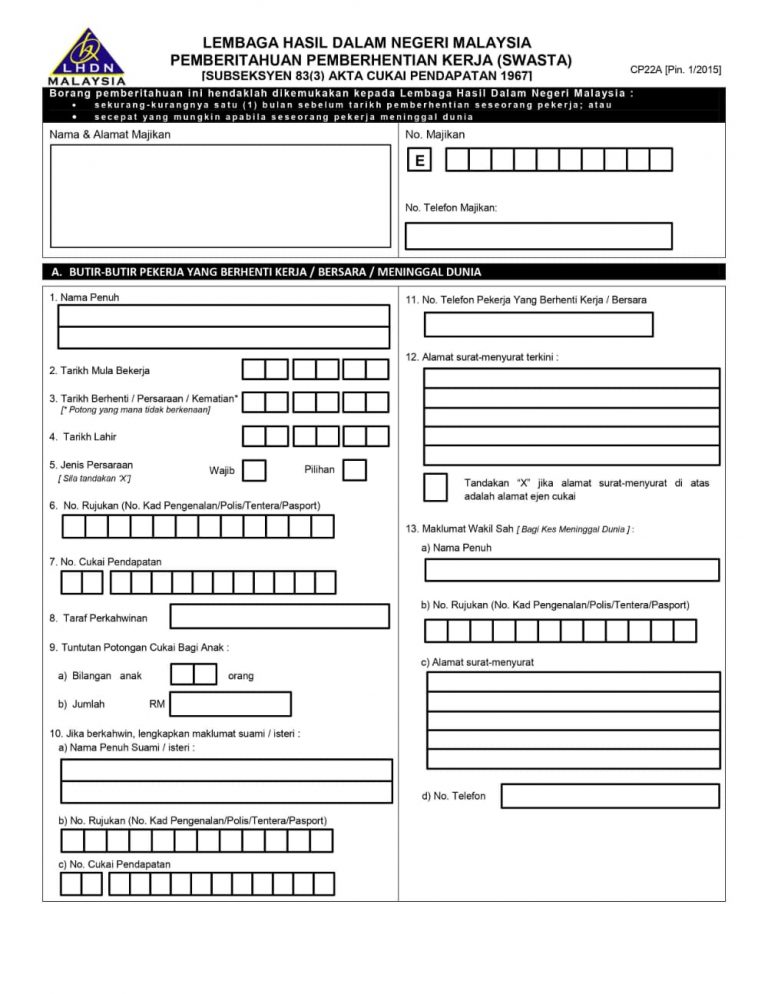

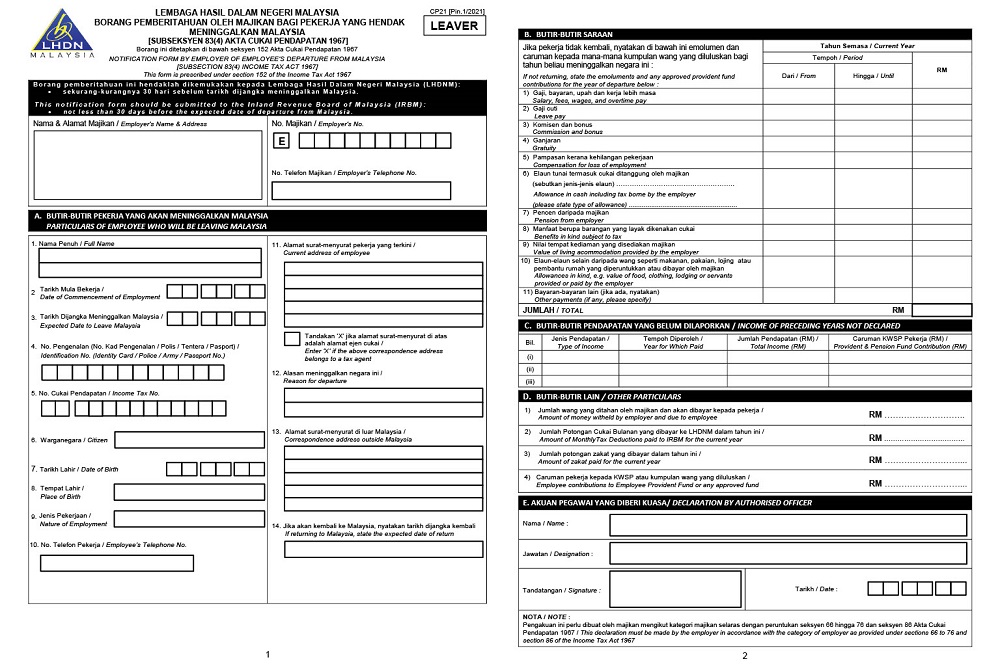

form cp22a lhdn

Ibu Pejabat Lembaga Hasil Dalam Negeri Malaysia. Relief From Stamp Duty.

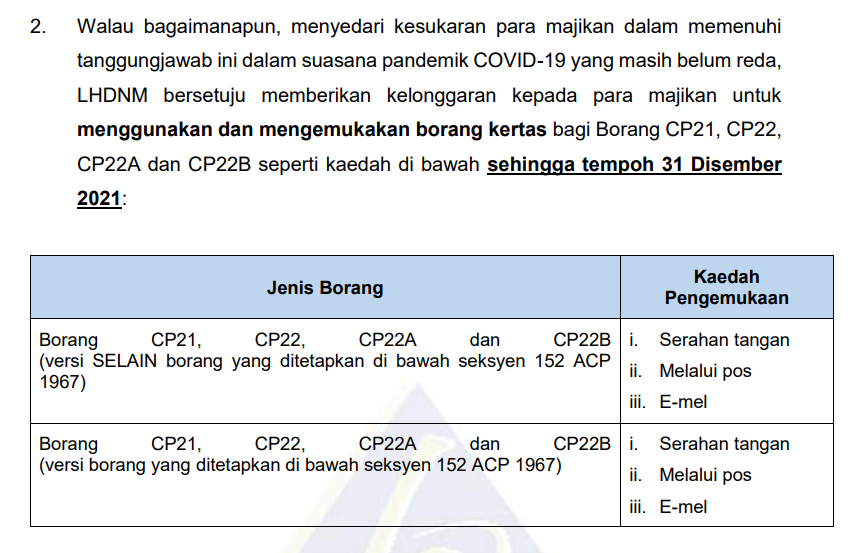

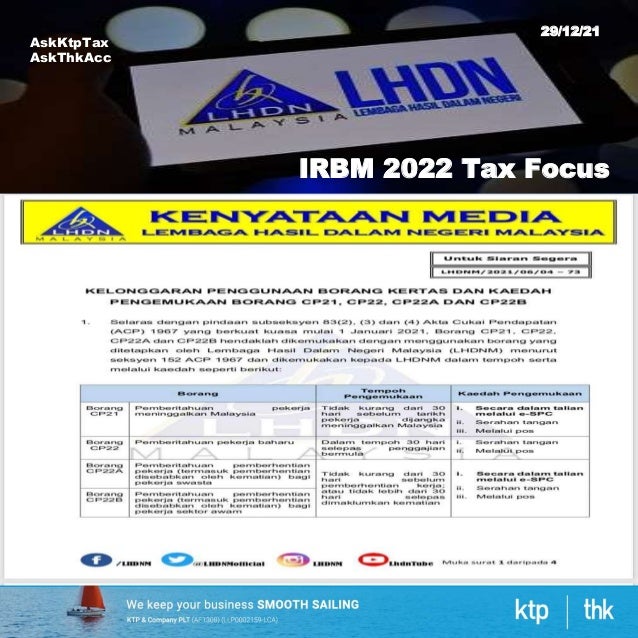

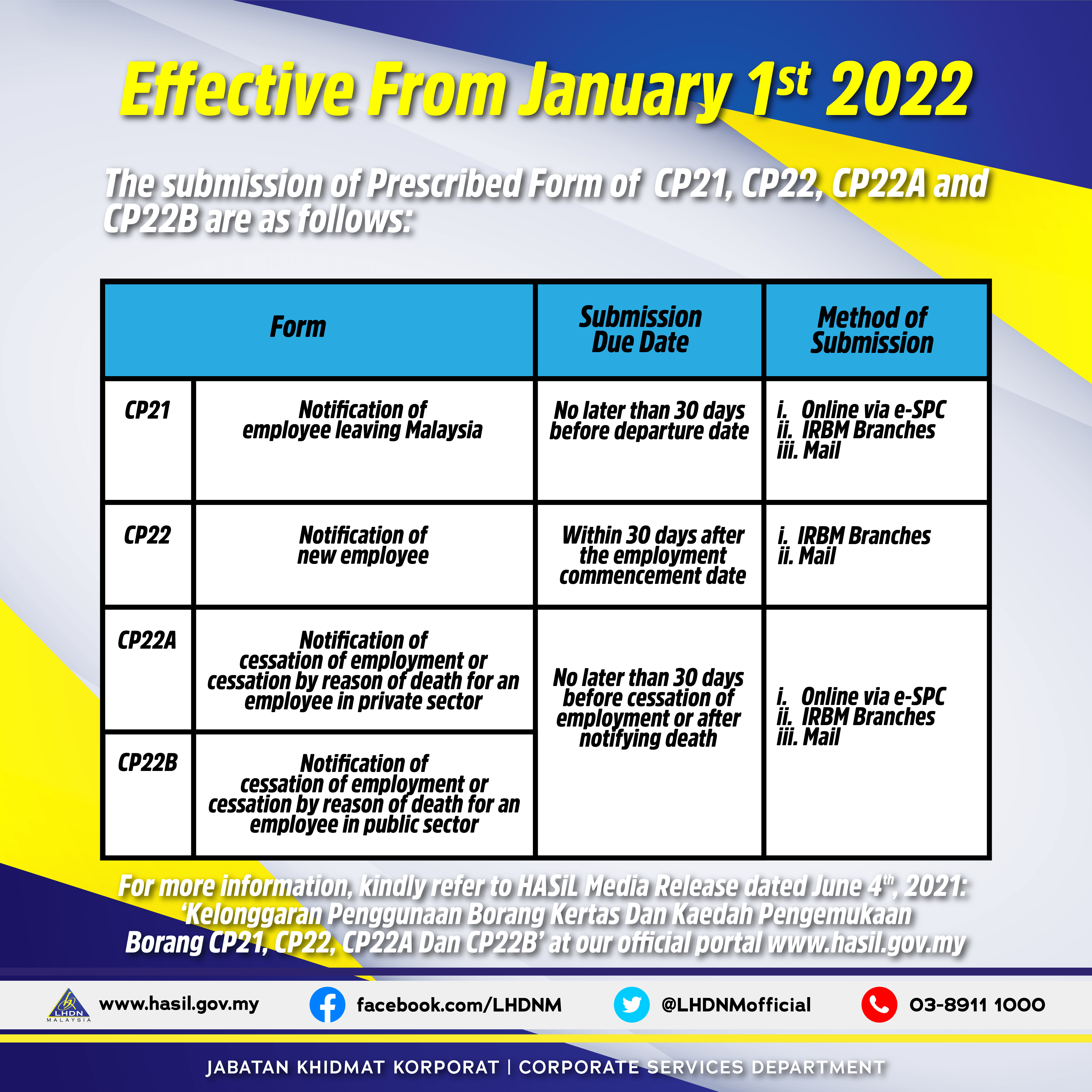

St Partners Plt Chartered Accountants Malaysia Tax Audit On Employer Need Provide Form Cp21 Cp22 Cp22a Kindly Be Informed That Form Cp21 Cp22 Cp22a And Cp22b Version Amendment

Form LE3 for Year of Assessment 2021 Year of Assessment 2020 under the ITA 1967 is on 31032020.

. This form can be downloaded and submitted to Lembaga Hasil Dalam Negeri Malaysia. The employee is about to retire. The submission of Return Form RF for Year Assessment 2021 via e-Filing for Forms E BE B M BT MT P TF and TP Forms commences on March 1st 2022.

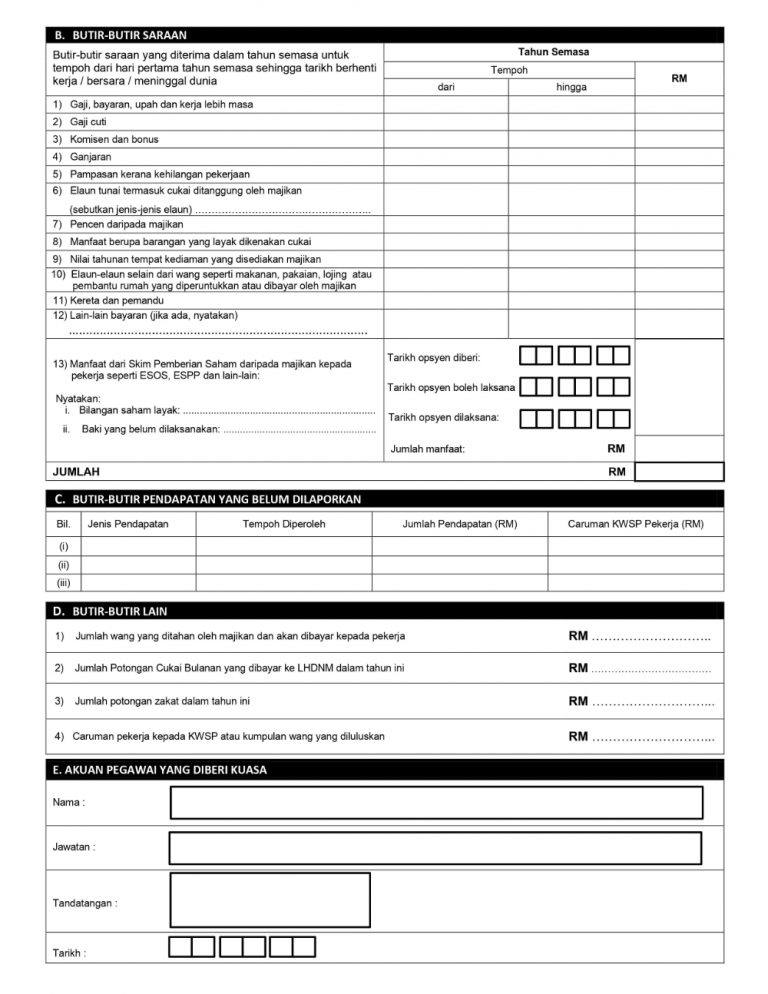

Retire or Cease from Employment in Malaysia Form CP22A. FORM CP22A. Statement of Monetary and Non-Monetory Incentive Payment to An Agent Dealer or Distributor Pursuant to Section 83A of the Income Tax Act 1967.

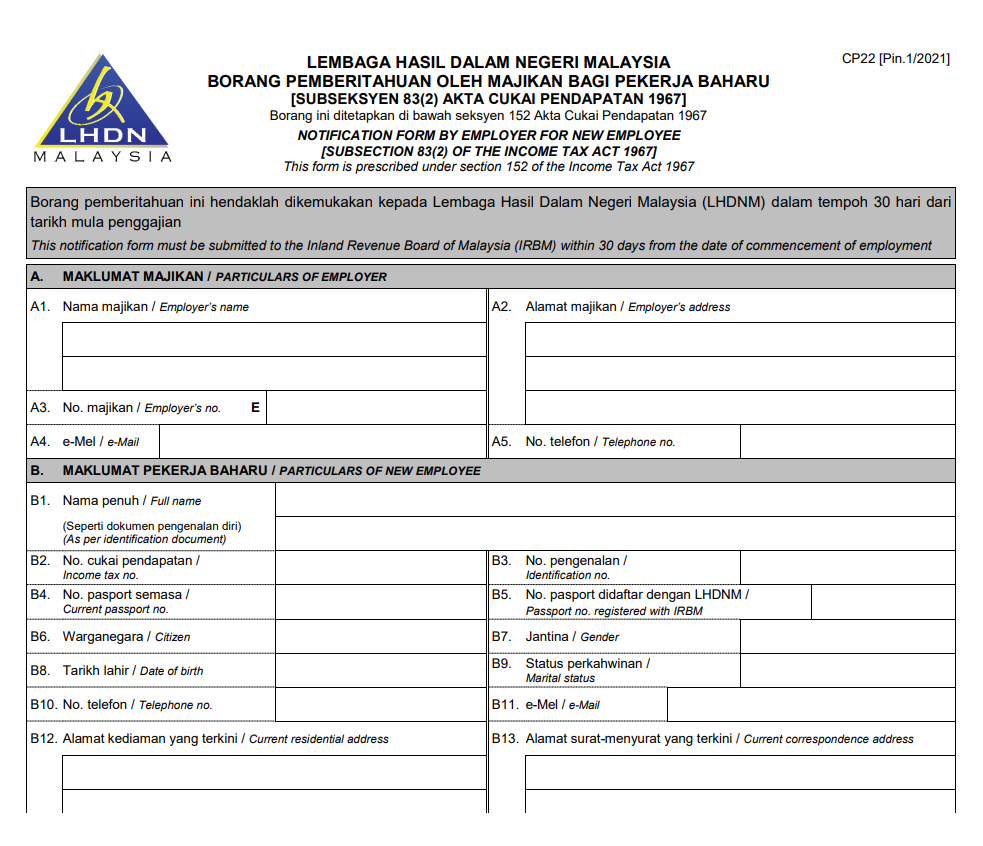

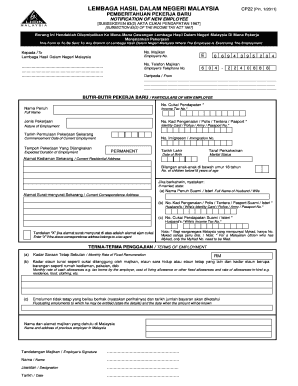

Criteria on Incomplete Form CP21 CP22 CP22A and CP22B Which is Unacceptable. While examples of non-monetary incentives are houses cars flight tickets. Form CP22 is a report from the government issued by the LHDN and also a form for New Employee Notification.

The due date for submission of Form LE3 for Year of Assessment 2022 Year of Assessment 2021 under the ITA 1967 is on 30042020. Basically it is a tax return form informing the IRB LHDN of the list of employee income information and number of employees it must be submitted by March 31 of each year. Employer is responsible for notifying Inland Revenue.

CP58 is an income statement that shows all incomes in the form of monetary and non-monetary incentives. Accounting period basis period for a Labuan entity is 01022020 31012021. Income Tax CP22 is a form that has to be submitted by the employer to notify LHDN on the newly recruited employees where else income tax form CP22A is a form that is submitted by the employer to notify LHDN on any employees in the cease of employment in forms of retirement or leave Malaysia permanently.

CP 22A - Tax Clearance Form. The employer must notify the local IRBM branch within 30 days after the new employees starting date. Form E Borang E is a form that an employer must complete and submit to the Internal Revenue Board of Malaysia IBRM or Lembaga Hasil Dalam Negeri LHDN.

Examples of monetary incentives are allowances and bonuses. If the employer fails to notify IRBM they will be prosecuted and liable to an RM200 to RM2000 fine or imprisonment for six months maximum. IRBMs Form CP22 is the Notification of New Employee form.

CP 58 form is given by the company to their agents dealers and sales distributors. FORM CP58 Description Form Type Notes. You are required to notify LHDN at least 30 days in advance by submitting Form CP22A and you must withhold any money payable to the employee until you receive a clearance letter from the LHDN in the following cases.

What Is Cp22 Cp22a Where To Download Cp22 Cp22a Sql Payroll

Changes In New Year 2022 Inland Revenue Board Lhdn

Changes In New Year 2022 Inland Revenue Board Lhdn

Kt Ng Associates Chartered Accountants Home Facebook

Hr Guide Tax Clearance Letter Form Cp22 And Form Cp22a

What Is Cp22 And Cp22a And How They Realted To Your Company

Download Your Personal Tax Clearance Letter Cp22 Cp22a

Ktp Company Plt Audit Tax Accountancy In Johor Bahru

Hr Guide Tax Clearance Letter Form Cp22 And Form Cp22a

Hr Guide Tax Clearance Letter Form Cp22 And Form Cp22a

What Is Cp22 Cp22a Where To Download Cp22 Cp22a Sql Payroll

Cp22 Form 2021 Online Submission Fill Online Printable Fillable Blank Pdffiller

What Is Cp22 Cp22a Where To Download Cp22 Cp22a Sql Payroll

No comments for "form cp22a lhdn"

Post a Comment